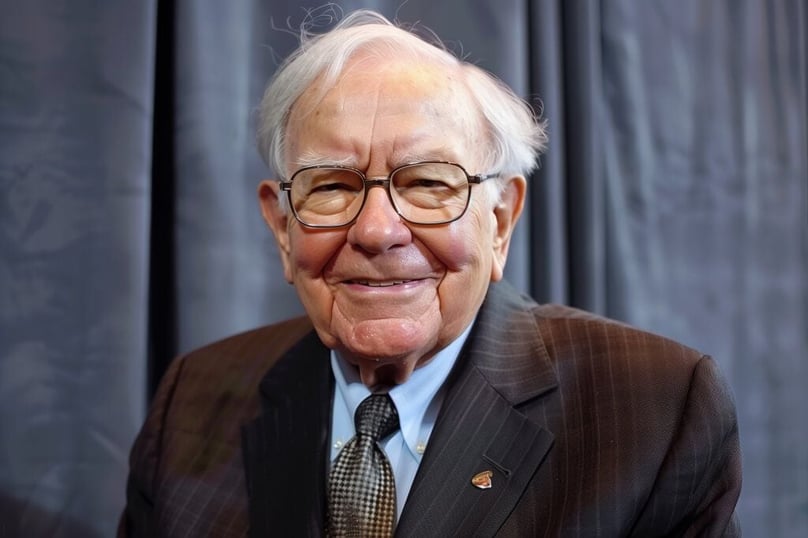

Warren Buffett, the investment guru affectionately known as the Oracle of Omaha, has been a staunch advocate of index funds, even going so far as to place a $1 million bet on their success. At Berkshire Hathaway's annual meeting in 2006, Buffett predicted that an index fund tracking the U.S. stock market would yield higher returns over ten years than any hedge fund. This bold claim led to a wager with hedge fund manager Tom Sedies, head of Protégé Partners LLC.

Despite initial doubts triggered by the 2008 financial crisis, Buffett's choice, the Vanguard 500 Index Fund, trounced Protégé's selection of hedge funds with an impressive 126% return compared to 36%. What made this victory particularly notable was the fund's link to Vanguard founder Jack Bogle, a figure Buffett credits with revolutionizing investor wealth.

At the Berkshire Hathaway annual shareholder meeting following his win, Buffett thanked Bogle publicly in front of thousands, estimating that Bogle's impact on the American investor translated into savings of billions and, potentially, hundreds of billions over time.

Buffett's victory served not only as a testament to his investment acumen but more significantly, as a compelling argument for the average investor to favor passive index funds over more costly actively managed funds. This story underlines the considerable influence of Jack Bogle - both in assisting Buffett's $1 million triumph and in making investing more profitable for the everyday individual by highlighting the unjustifiable nature of most active manager fees.