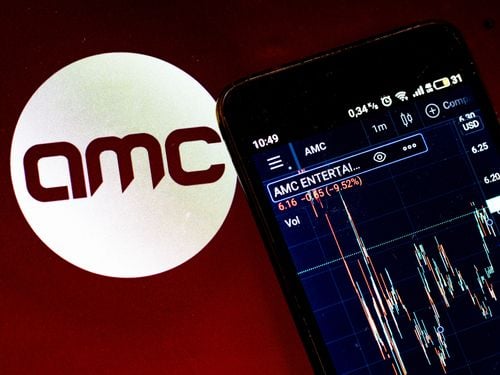

Shares of AMC Entertainment Holdings surged recently, witnessing around a 10% climb following an upgrade by Wedbush Securities. The movie theatre chain which has been known as a "meme stock" over the years is now positioned to see more steady releases over the upcoming quarters according to analysts at Wedbush. They have elevated the stocks from "neutral" to "outperform". Gaining more market share in 2025 and 2026 is in sight for AMC with the largest number of premium screens in North America and plans for expansion in Europe and the UK.

A crucial observation by the analysts is that AMC has managed to either postpone or repay all its debt that was due next year, this alarms an eased-up condition for the theatre chain. Furthermore, the company is finalizing what is expected to be its last major share issuance for some time which puts a considerable "headwind behind it". Even after the recent surge, the stock remains 17% lower than this year.

Wedbush has set a new price target for AMC at $4, a 33% premium compared to the close of Thursday. Despite having lesser coverage on Wall Street, Visible Alpha recorded no "buy" or equivalent ratings on the shares until before today.